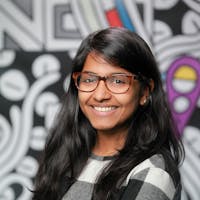

About Krishna

For the past four years, Krishna Prajapat has been working hard running her small embroidery business to add to her family's income. She works eight hours a day for seven days a week offering her skillful services to customers to support her parents and her brother. Now, Krishna wants to scale up her business to grow her monthly income. She has applied for a loan to finance the purchase of fabric of different designs, a proper cloth cutting table, and a new sewing machine to magnify her output. By growing her business and her income, Krishna hopes to support her brother continue studying and also dreams of being able to pitch in to cover his marriage expenses. Her dream is to open her own wholesale clothing store in her village to support her parents and better their quality of life. Fund Krishna's ambitious business venture today.